05 December 2017

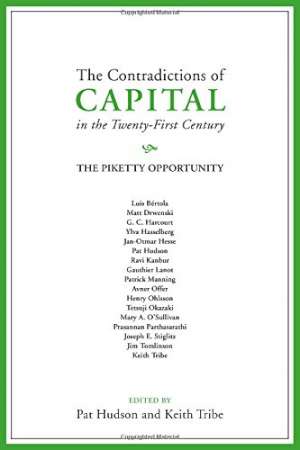

The Contradictions of Capital in the 21st Century

Pat Hudson and Keith Tribe

2016, Agenda Publishing, 240 pages,

ISBN 9781911116110

Reviewer: Bridget Rosewell, Senior Partner, Volterra

This volume of essays starts from the premise that Piketty’s Capital in the 21st Century is a wonderful book, challenging both theory and measurement. Nonetheless, every author is highly critical either of its concepts, its measurement techniques, its policy prescriptions or indeed all of these.

On the conceptual side, almost all of the authors point out that capital and wealth are by no means the same thing and that Piketty uses a neoclassical production function framework which should properly be applied to capital K and conflates it with wealth W, defined as any asset that can have a market value – anything from houses to fine wine.

From pointing this out, some authors move on to discussing the measurement challenges. There are varied challenges here, from the absence of measurements at the lower end of the income distribution to the absence of any measure of collective wealth. This latter challenge, most notable in the paper by Hasselberg and Ohlsson on Sweden, seems very important to me and is insufficiently covered.

Piketty assumes that collective government wealth is in a fixed ratio with private wealth and is offset almost completely by sovereign debt. Hence he ignores it. But the rise of pension entitlements and the implied asset that these represent cannot be ignored so glibly. Pension spending is over 40% of government spending and 8% of GDP. The rising importance of this, its implied asset base, and the wealth this corresponds to, is crucial to thinking about wealth distribution. Of course, tax and benefit arrangements can be rewritten, but to ignore them in thinking about a tendency for the rich to scoop more of the pool on a continuous basis seems perverse unless the rise of pension entitlements is taken into account. In these papers, life cycles are barely mentioned, and nor is generational transfer, although these are both live current issues in policy. According to the IFS, the median pensioner now has higher weekly disposable income after housing and dependant costs than the median worker. What does this mean for wealth and capital?

Another aspect of wealth accumulation which gets attention in many of the papers as an omission is housing wealth. It is the inclusion of housing wealth that ensures that capital grows faster than income – at least it would appear to, though none of these authors provide exactly that calculation.

This volume is, I hope, the first step in unpacking both the assertions and the opportunities created by Piketty. One question raised by Harcourt and Tribe in the first essay in the series goes to the heart of the issue – which is the assertion that inequality is bad. They ask if this it true but cannot provide an answer. It might of course be that inequality is inevitable but the fight to remove it is still worthwhile. It might be, as the stylised facts used to show, that increasing inequality is a necessary part of creating effective markets which creates the level of GDP which makes reducing inequality and raising all living standards possible. This stylised fact has been challenged by more recent rises in inequality of incomes.

However, this does not make it clear which is the more ‘natural’ state, let alone whether the rise of the rentier is a necessary law of capitalism. It may just as well be that there are long cycles in such patterns and that the Kuznets cycle challenged by Piketty is just about to repeat itself.

Marxists in particular like to find general laws that permit long swings of history and support both the immiseration of the proletariat and the long run decline in the rate of profit. The twentieth century largely bucked this trend. A visceral dislike of capitalism would like to see it resume in the 21st, but it isn’t clear from Piketty or from this volume that either the statistics or the concepts support this conclusion.

This is not to say that the matter is closed. Pat Hudson’s essay sets out the agenda that needs to be followed to unpack the institutional, political and geographical trends, while the essays about non-Western countries also set out how the picture can be quite different. Everywhere appears to be an exception to the rule – in which case the rule, whatever it may actually be, does not seem to have much meaning.

At present, there are some knotty conundrums about the role of new technology in productive capital, and whether investment is less finance intensive than previously. There are big questions about pension wealth, and about the monetisation and financialisation of economies. How far can sale and leaseback go, if increasingly economies are in hock, while their populations expect a lengthy retirement?

We now need another volume which begins to set out some of the statistics surrounding these questions. Piketty managed to avoid too much algebra or the swamps of multiple regressions which purport to separate out factors which are in fact interdependent. But he probably asked the wrong question in focusing on wealth and incomes of the top 10 percent. It’s the median which matters.